A living trust is one of the most effective estate planning tools for high-net-worth Canadians who want to maintain control over their wealth, minimize family disputes, and protect their privacy. While wills are common, they often leave your estate vulnerable to probate delays, public scrutiny, and taxation pitfalls that a living trust can often sidestep entirely. It’s not a solution for everyone, yet for many with complex assets or significant wealth, it offers something that a will simply can’t control now and later.

Key Takeaways

- A living trust offers high-net-worth individuals in Canada more control, privacy, and continuity during incapacity or death.

- It helps avoid probate, reduces family conflict, and streamlines wealth transfer.

What Is a Living Trust?

A living trust is a legal arrangement where you transfer ownership of your assets into a trust that’s managed during your lifetime and then distributed to beneficiaries upon death, without court involvement. In Canada, most living trusts are revocable, meaning you can update or cancel them as long as you’re mentally capable. They’re designed to give you flexibility while also setting the foundation for a smoother estate transition.

Unlike a will, a living trust becomes effective the moment it’s funded. That means it’s working while you’re alive, not just after you’re gone.

Why Living Trusts Matter for High-Net-Worth Canadians

Living trusts are particularly important for high-net-worth Canadians because the more wealth you have, the more you risk losing control over how and when it’s passed on, especially if things go through probate. Without a trust, families often face delays, legal costs, public scrutiny, and internal conflict during what’s already an emotionally complicated time.

Estates valued in the millions attract attention, sometimes from the wrong people. Probate courts are public. So are wills. That combination can create friction within families and even trigger unnecessary taxation or legal challenges. A living trust adds a protective layer that shields your family from some of that exposure.

Key Features of a Living Trust

A living trust is made up of specific roles and processes that, together, create a living framework for wealth management during and after your lifetime. It starts with you, the grantor, and continues through trustees and beneficiaries, with legal and financial steps in between.

There are three core roles:

- Grantor: The one who creates the trust and puts assets into it.

- Trustee: The person or people responsible for managing the trust.

- Beneficiaries: Those who will eventually benefit from the trust’s assets.

Once the trust is signed and funded, it needs regular maintenance. Think of it like a living portfolio, part legal tool, part financial plan, part peace-of-mind mechanism.

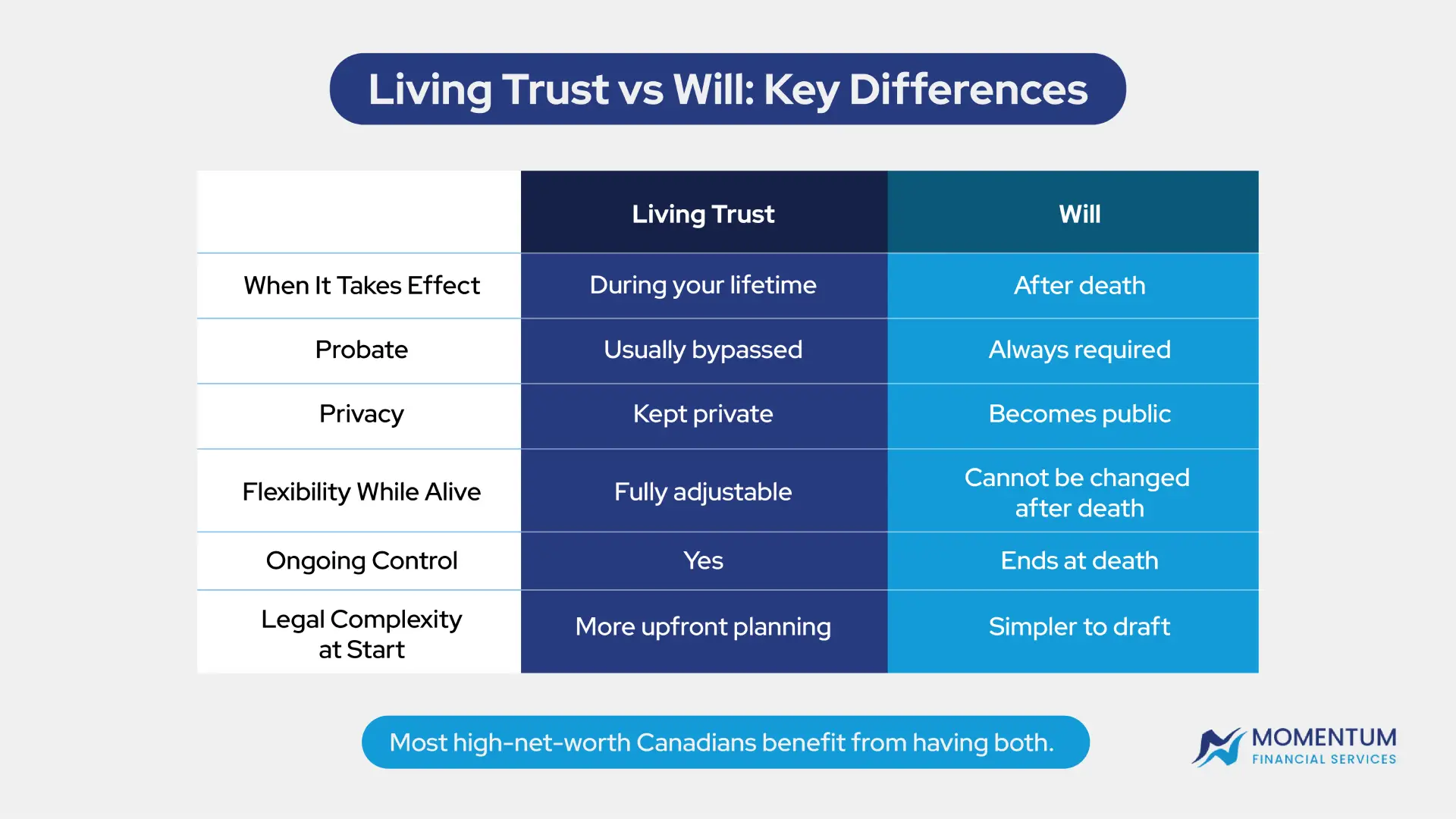

Living Trust vs Will: What’s the Difference?

The key difference is that a living trust starts working during your lifetime, while a will only applies after death. This changes how and when your assets are managed, and by whom. Both tools distribute your estate, even if a living trust does so with less court involvement and more discretion.

Here’s a quick comparison to bring that into focus:

Quick Definitions:

- A will is a legal document that outlines how your assets will be distributed and who will care for any dependents after your death. It must go through probate, which is a public and court-supervised process.

- A living trust is a legal arrangement that holds and manages your assets while you’re still alive and directs how they’re distributed if you become incapacitated or pass away. It usually avoids probate and offers more privacy and control.

What They Have in Common:

- Both let you name beneficiaries and decide how your assets are divided.

- Both are legal tools designed to express your wishes and guide estate settlement.

What Sets Them Apart:

- A living trust is active during your life and continues without interruption, while a will only comes into effect after your death.

- Trusts avoid probate and keep your affairs private; wills don’t.

You might still need both. A will can handle guardianship decisions and catch anything the trust missed. As for asset flow and estate control? A living trust wins on most fronts.

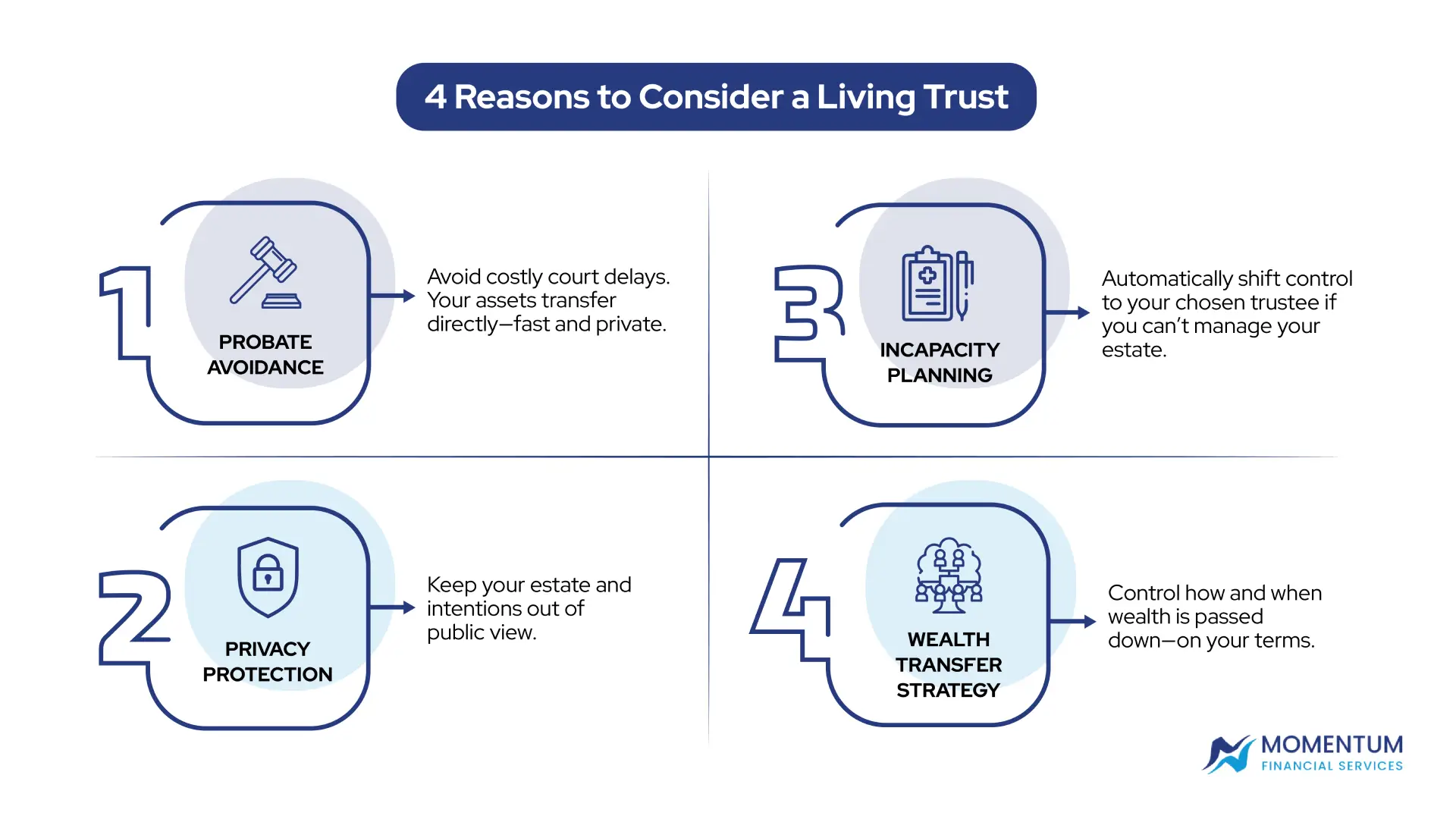

4 Practical Benefits of Living Trusts

Living trusts offer clear, tangible advantages that go beyond just avoiding probate. These benefits help protect your family’s future, your privacy, and your personal autonomy if something goes wrong with your health.

Probate Avoidance

One of the most immediate benefits of a living trust is that it can allow your estate to bypass probate. That means your assets don’t get tied up in a court-supervised process that can take months, or longer, depending on the province and whether anyone challenges your wishes.

Probate isn’t just slow. It can also be expensive and public. Filing fees, legal bills, and required appraisals all eat into the estate’s value. More importantly, your loved ones might find themselves stuck waiting during a period when they need resources most. A properly funded living trust can transfer property, investments, and other holdings quickly and privately. Sometimes in days, not months.

Privacy Protection

Wills become public documents once they’re filed with the court, which means anyone, journalists, business competitors, estranged relatives, can request a copy and review your assets, debts, and family dynamics. It’s an uncomfortable truth that often goes overlooked until it’s too late.

Living trusts, by contrast, operate outside the court system. Because there’s no requirement to file the document publicly, your wealth, your intentions, and your beneficiaries remain confidential. That privacy matters more if you’re prominent, wealthy, or simply prefer not to have your financial life dissected in public after you’re gone.

It’s not just about discretion. It’s about control over who sees what, and when.

Incapacity Planning

If you become mentally incapacitated due to illness, injury, or cognitive decline, a living trust provides an immediate, built-in mechanism to maintain continuity without the need for a court order. Your named successor trustee simply steps in and begins managing the assets on your behalf, according to the instructions you’ve already laid out.

That’s far less stressful than applying for legal guardianship or relying entirely on a power of attorney, especially when banks or financial institutions challenge its authority, which, unfortunately, still happens. A living trust creates a seamless handoff. It’s proactive. Quiet. And it keeps you and your family out of an already-overloaded legal system at a vulnerable time.

Think of it as a preloaded plan for “what if something happens,” rather than a scramble to fix it after the fact.

Intergenerational Wealth Transfer

Most people think of estate planning as just “who gets what,” on the other hand a living trust allows you to go deeper. You can stagger inheritances over time, set conditions based on age, education, or behaviour, and assign separate trustees to manage the assets for minor children or vulnerable beneficiaries.

You can even outline incentives, like holding off major distributions until someone finishes a degree or reaches a certain level of maturity. It’s not about control for control’s sake. It’s about guiding the values that come with wealth.

And if you want to make provisions for multiple generations, grandchildren, future charitable gifts, or blended family dynamics, a trust gives you the structure to do that clearly and without confusion.

Learn About Deemed Disposition Every 21 Years

Canada’s 21-year rule automatically triggers a capital gains tax on property held in most living trusts, even if nothing is sold.

This rule exists to prevent families from indefinitely deferring taxes by using trusts. If you’ve placed investment properties, shares, or a family cottage inside a trust, the CRA treats those assets as though they’ve been sold every 21 years; at fair market value. That phantom sale is called a deemed disposition, and it can trigger a real tax bill with no actual sale proceeds to cover it.

Understanding this rule is crucial if you’re using a trust as part of your succession, estate, or tax strategy.

What Does “Deemed Disposition” Actually Mean?

At the 21-year mark after a trust is created, the CRA assumes the trust has sold all its capital property at current fair market value; even if the property is still held.

- This includes real estate, stocks, corporate shares, and other capital assets.

- The gain is calculated as if the property were sold and immediately repurchased at today’s market value.

- That paper gain becomes a taxable capital gain, and the trust must pay tax on it.

If no action is taken before that deadline, the trust could face a large tax liability, without any liquidity to pay it.

Who Does the 21-Year Rule Apply To?

The rule applies to most inter vivos trusts; those created during your lifetime.

- Common examples include family trusts and joint investment trusts.

- Exceptions include alter-ego trusts, joint partner/spousal trusts, and testamentary trusts (trusts created at death), which follow different timelines.

If you’ve set up a trust for legacy planning or business succession, and it holds appreciating assets, this rule likely applies to you.

Planning Around the 21-Year Rule

If you’re within a few years of your trust’s 21-year anniversary, you have several planning options. Each strategy comes with trade-offs, so timing and expert guidance are key.

Option 1: Distribute Assets to Beneficiaries

Many trusts allow a tax-deferred rollover of assets to Canadian-resident beneficiaries before the 21-year mark.

- This avoids the deemed disposition.

- The capital gains tax is deferred until the beneficiaries sell or pass away.

- You shift the future tax liability to them, and move assets out of the trust’s control.

Option 2: Trigger the Gain and Pay the Tax

You can choose to “bite the bullet” and let the trust pay the capital gains tax.

- Useful if you want to keep the trust structure intact.

- Requires available cash or liquid assets to pay CRA; otherwise, you may need to set up a payment plan.

This keeps the trust going but comes at the cost of an immediate tax hit.

Option 3: Sell the Property Pre-21

If a trust holds investment property or a vacation home, you can sell it before the deemed disposition.

- The trust pays the capital gains tax on the sale.

- You gain liquidity and may reinvest or distribute cash to beneficiaries.

It’s a more controlled outcome than being surprised by a deemed sale with no funds.

Option 4: Wind Up the Trust

If the trust’s purpose is fulfilled, you can simply wind it up.

- All assets get transferred to beneficiaries.

- Depending on how it’s structured, this may happen on a rollover basis, deferring tax until later.

It’s a straightforward way to end the trust before hitting the tax wall.

Option 5: Vest Interests Indefeasibly

This legal strategy allows you to transfer assets into a new trust where beneficiary interests are fixed and irrevocable.

- The 21-year clock restarts in the new trust.

- Beneficiaries must have clearly defined, unchangeable rights.

It’s complex and requires professional legal work, but it can extend tax deferral across generations.

Why This Rule Matters for High-Net-Worth Canadians

If your living trust holds a cottage, family business shares, or a stock portfolio, this rule can erode wealth silently if ignored.

- You may face a large tax bill with no cash proceeds to pay it.

- Appraisals are essential; the CRA will assign its own fair market value if you don’t.

- Poor planning can force premature asset sales or family conflict.

With early action, the 21-year rule becomes a planning tool, not a penalty. The key is identifying your trust’s anniversary date and developing a plan that aligns with your goals.

When a Living Trust May Not Be Ideal

A living trust isn’t the best tool in every situation, it can be too complex, too costly, or simply unnecessary. If your estate is relatively small, or if your assets are straightforward (think one house, one account, few heirs), a well-drafted will might be enough.

Some people also underestimate the administrative side. You have to transfer assets into the trust properly. That means paperwork. Titles. Banking changes. If you skip those steps, the trust loses its effectiveness, and that’s a common misstep.

So while the benefits are real, it’s worth asking: Is this the right fit for your specific needs, or are you solving a problem you may not have?

How to Set Up a Living Trust in Canada

Setting up a living trust in Canada involves multiple steps; in contrast, it’s not as daunting as it sounds, especially with the right legal support. It’s mostly about clear documentation, proper setup, and a bit of ongoing attention.

Here’s how it typically unfolds:

- Choose a Trustee: Often yourself, with a reliable successor named.

- Meet with an Estate Lawyer: Ideally, one who works with high-net-worth families.

- Draft the Trust Agreement: This defines what’s included and how it’s managed.

- Transfer Assets: Bank accounts, property titles, even shares must be re-registered.

- Review Annually: Especially if you acquire new assets or experience a major life change.

Professional advice isn’t optional here. The cost of getting it wrong often outweighs the cost of doing it right.

FAQ

Is a living trust taxed differently during my lifetime?

No. If it’s a revocable living trust, you’re still taxed on the income as if you personally own the assets. Only after death does the trust potentially face different tax rules.

Can I still control my assets after putting them in a trust?

Absolutely. As the grantor and trustee, you manage everything as before. The difference is that the legal ownership sits with the trust, giving your estate more structure and resilience.

Conclusion: A Smart Move for Long-Term Control

A living trust isn’t just a legal document, it’s a strategy. It’s a way to maintain control while you’re alive, protect your family’s privacy, and pass on wealth according to your rules.

It may take some effort up front. You’ll need to meet with an estate lawyer, make decisions, maybe even change how you title some assets. Yet what you get in return is clarity. And continuity. And confidence that your estate won’t be left in limbo when your family needs stability most.

If you’re not sure whether a living trust fits your situation, don’t guess. Talk to a professional. Because if you wait until something goes wrong, it may already be too late to make the easy choice.