Donor-advised funds (DAFs) offer a flexible and tax-efficient way to give, and in hindsight, they can also lead to missed opportunities or unintended headaches if not approached with care. Even if you’re just setting one up or already making grants, understanding the most common pitfalls can help ensure your giving aligns with your values, your tax plan, and your legacy.

Key Takeaways

- Clarifying your charitable goals early helps ensure your giving remains focused and impactful.

- Tax planning around DAF contributions and grants requires more timing and nuance than many realize.

- Choosing the right sponsor and involving your family can determine the long-term success of your fund.

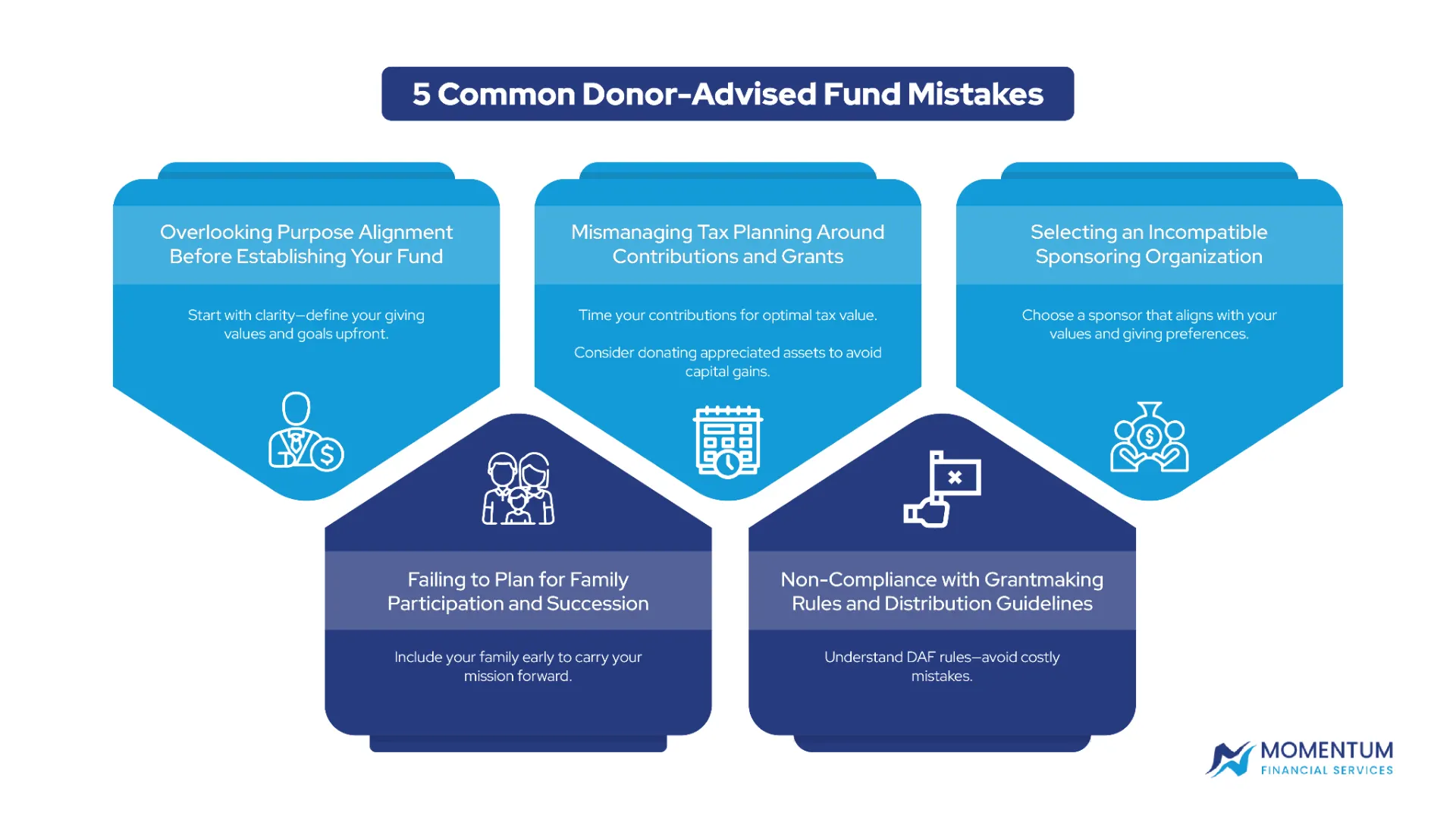

1. Overlooking Purpose Alignment Before Establishing Your Fund

Most people assume that opening a DAF is the hard part. It’s not. The harder part is deciding what exactly you want it to achieve.

A surprising number of donors skip this first step, or treat it as a vague intention to “do good.” And that’s not enough. Without a clearly defined mission or focus area, your giving can become scattered. You might support a bit of this, a bit of that, and eventually feel uncertain if you’re really making a difference. The downside is that your enthusiasm could wane altogether.

Start by asking yourself a few grounding questions. What cause keeps pulling your attention? Is it education, environmental preservation, food insecurity? What values do you want your giving to reflect? Write them down, even if it feels a little formal.

The clarity doesn’t just guide your future decisions; it also becomes something your family can understand and carry forward, especially if you plan to involve them later.

2. Mismanaging Tax Planning Around Contributions and Grants

Let’s be honest: many people are attracted to DAFs for the tax benefits. And that’s fair. And that doesn’t mean the timing or strategy behind contributions is always handled well.

One common misstep is contributing cash when you could have donated appreciated stock. By doing the latter, you might have avoided capital gains tax and still received a full deduction. Seems obvious in hindsight, yet it’s often missed in the moment.

Another issue? Timing. Contributions made in a high-income year can offer significantly more tax value than in a lower-income one. The same goes for grantmaking, some donors try to “catch up” with a large flurry of grants at year-end, which can lead to rushed decisions.

If you’ve ever found yourself trying to finalize donations in late December, you’re not alone. That approach often leads to donor fatigue or giving that lacks strategy.

3. Selecting an Incompatible Sponsoring Organization

Not all donor-advised fund (DAF) sponsors are the same, and yet, many donors choose the first one recommended by a friend, their financial advisor, or whichever large institution makes the process sound easy. This works up until it doesn’t.

Maybe you’re someone who wants to invest the DAF assets in ESG funds, even though your provider doesn’t offer that option. Or perhaps you’re looking to support a grassroots nonprofit overseas, and your sponsor has strict limitations.

The key is to pause before opening an account and ask: What do I want out of this relationship? How much control do I want over investments? Are there grant restrictions? What’s customer service like?

It’s not just about fees, although that matters too. It’s about philosophical alignment. You don’t want to discover three years in that your sponsor doesn’t allow grants to certain registered Canadian charities you care deeply about.

4. Failing to Plan for Family Participation and Succession

Another trap is thinking a DAF is only about your lifetime giving.

It isn’t. In fact, one of the most powerful aspects of a donor-advised fund is its ability to become a teaching tool, a unifying purpose, or even a family tradition.

However, that only happens if you’re intentional.

Succession planning matters, especially if you want children or other family members to continue your charitable legacy. Too many accounts go dormant or inactive because successor advisors were never named. Or worse, the next generation has no idea why certain grants were made in the first place.

If you want your giving to live on, and you probably do, bring your family into the conversation early, even if it’s just to listen at first.

Some families use annual grantmaking meetings to decide causes together. Others assign “giving budgets” to each member to explore their own philanthropic interests. There’s no perfect formula, but leaving a roadmap (or at least a few notes) helps.

5. Non-Compliance with Grantmaking Rules and Distribution Guidelines

This part tends to catch people off guard. While DAFs offer flexibility, they’re not without rules.

Some donors have unintentionally tried to direct grants to organizations that aren’t qualified public charities. Others have attempted to fulfill personal pledges with their fund, only to discover that’s a no-go.

Still others simply forgot to make grants altogether. Yes, technically, DAFs don’t require annual distributions like private foundations; they require many sponsors to expect regular activity. Inactivity can raise red flags, especially as regulators start paying closer attention to DAF transparency.

It’s not always about ill intent. Sometimes people just get busy. The key is staying informed and checking in with your fund administrator or advisor if you’re unsure. Better to ask a “dumb” question now than risk penalties later.

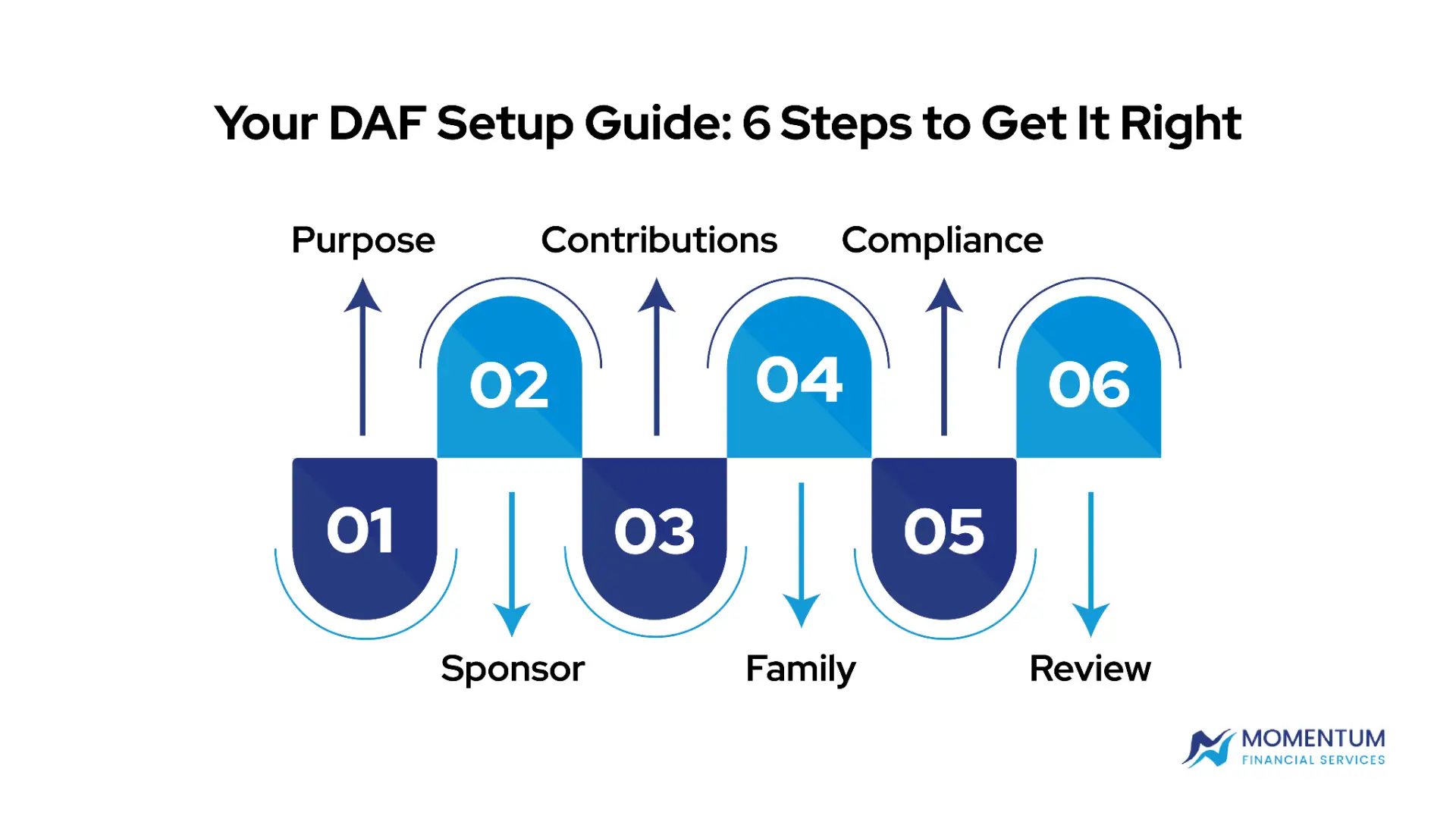

Proven Strategies to Set Up Your Donor-Advised Fund Effectively

Getting your DAF right from the beginning can help you avoid common missteps and make your giving more rewarding. This isn’t about being perfect, it’s about being thoughtful, realistic, and prepared. Here’s a practical step-by-step approach to help you get started:

Step 1: Define your purpose. Write down a few causes you care about and the values you want your giving to reflect. This will serve as a guidepost when you’re deciding where and how to give.

Step 2: Choose a sponsor that fits your needs. Look beyond fees. Review each sponsor’s investment options, grantmaking rules, tech platform, and their willingness to support the kinds of organizations you care about.

Step 3: Plan your contributions strategically. Coordinate with your tax advisor to determine the best timing and asset type for contributions, especially if you have appreciated stock or expect a high-income year.

Step 4: Involve your family early. Even just asking for input can help make your giving more inclusive. Assign roles or grantmaking responsibilities, and talk openly about why you give.

Step 5: Keep tabs on activity and compliance. Set a reminder to make regular grants and stay informed about IRS rules. When in doubt, ask your sponsor for clarification.

Step 6: Revisit and refine annually. Your goals might evolve, and that’s fine. Make time once a year to review your giving strategy and adjust based on what matters most to you now.

Following these steps won’t guarantee perfection. On the bright side, they’ll help you avoid the most common mistakes, and make your donor-advised fund something you’re genuinely proud of.

Frequently Asked Questions (FAQ)

Can I take back money I’ve contributed to a donor-advised fund?

No. Contributions are irrevocable. Once you donate, the funds must be used for charitable purposes.

What types of charities can I support through a DAF?

You can recommend grants to any qualified Canadian registered charity. Your DAF sponsor typically confirms eligibility before disbursing funds.

Can I make anonymous donations through my DAF?

Yes. Most sponsors offer the option to make grants anonymously if you prefer to keep your identity private.

Final Thoughts: Make Every Dollar of Generosity Count

Mistakes with donor-advised funds are usually preventable. And with a bit of forethought, defining your purpose, planning with your advisor, involving your family, you’ll not only avoid headaches, you’ll amplify your impact. A well-run DAF should reflect your values, support your legacy, and give you clarity and confidence in your giving.

If you’re thinking about creating or optimizing a DAF, reach out to us at Momentum Financial Services. We’ll help you align your charitable strategy with your long-term financial goals, and make giving feel as rewarding as it should be