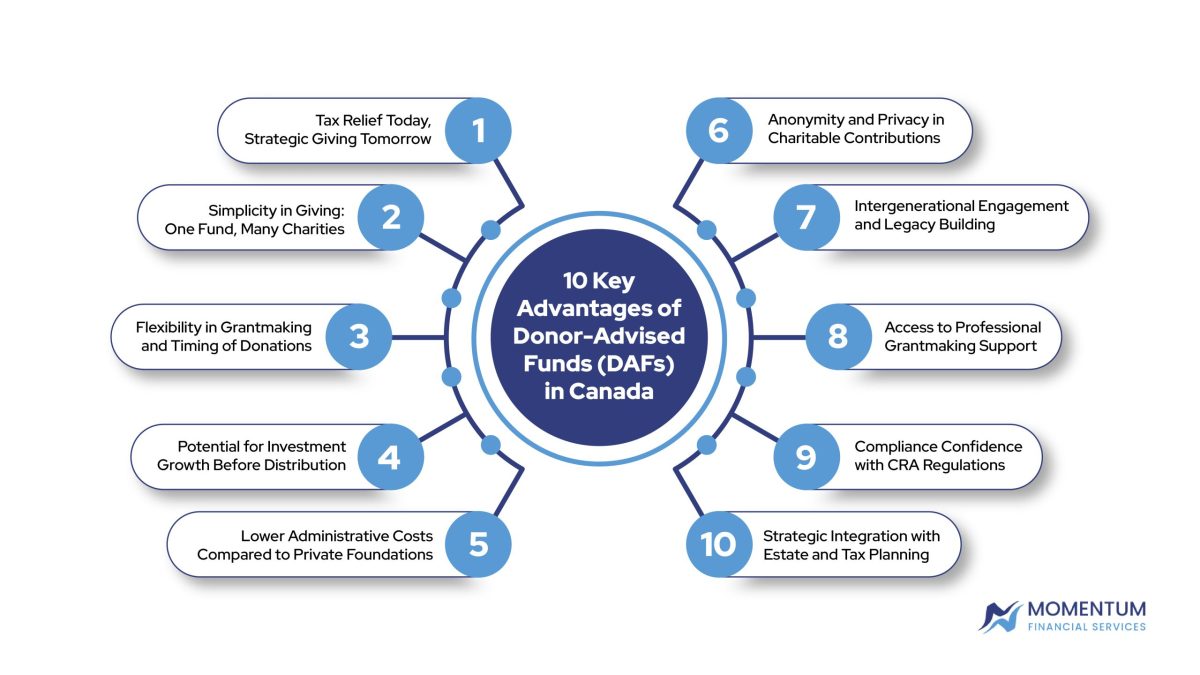

Donor-Advised Funds (DAFs) have become a go-to tool for Canadians looking to give with more structure, flexibility, and tax efficiency. And while they’re not new, their benefits are often underappreciated or misunderstood. Even if you’re just exploring philanthropic vehicles, already giving regularly, understanding what makes them work so well reveals the key advantages of donor-advised funds.

Key Takeaways

- DAFs provide immediate tax relief while giving you time to decide how and when to make grants.

- You can consolidate all your charitable giving under one fund, simplifying both strategy and administration.

- DAFs also offer privacy, legacy-building opportunities, and integration with broader tax and estate plans.

1. Tax Relief Today, Strategic Giving Tomorrow

One of the standout features of DAFs is the timing flexibility. You get an immediate tax deduction the moment you contribute, even if you don’t know yet where you want that money to go. That breathing room matters, especially when you want to give thoughtfully, not hastily.

Maybe this year’s income is unusually high. Perhaps you sold a business or received a large bonus. A DAF lets you claim the deduction now while planning out your grantmaking over the next year, or even the next decade.

2. Simplicity in Giving: One Fund, Many Charities

Handling donations to multiple organizations can feel disjointed. Receipts from five places, bank transfers going every which way, and the inevitable moment when you forget if you actually donated to that one charity you meant to. A DAF bundles it all.

You donate once to the fund. Then, when you’re ready, you recommend grants to as many charities as you like. One account. One statement. A lot less mental clutter. It’s one of the often-overlooked advantages of donor-advised funds.

3. Flexibility in Grantmaking and Timing of Donations

Giving isn’t always linear. There are years when you’re more engaged and years when you’re not. Sometimes you want to hold back until a specific event, like a natural disaster, a major campaign, or even a downturn when certain charities really need help.

DAFs let you wait. You can let the funds sit until you’re confident about where they’ll make the most impact. You’re not rushing to meet a December 31st deadline, either. That’s already taken care of.

4. Potential for Investment Growth Before Distribution

Here’s a lesser-known advantage: DAF contributions can be invested before they’re granted out. Which means the money you donate today might actually grow, tax-free, while you wait to make your decisions.

It’s not about playing the markets recklessly. It’s about giving your charitable dollars the chance to do even more. That bit of growth? It might fund an extra scholarship, a few more meals, or another month of programming. Among the top advantages of donor-advised funds, this potential for growth often surprises people.

5. Lower Administrative Costs Compared to Private Foundations

Foundations sound impressive. And in some cases, they make sense. However, they’re not always practical, especially for donors who don’t want the burden of annual filings, governance rules, or detailed reporting.

DAFs are lighter. There’s usually a modest administrative fee, and the sponsoring organization handles compliance, disbursements, and record-keeping. It’s a more accessible structure without sacrificing strategic potential. This alone is one of the clearest advantages of donor-advised funds.

6. Anonymity and Privacy in Charitable Contributions

Some people like to stay under the radar. Not because they’re secretive, rather because they believe giving should be about the cause, not the recognition. DAFs offer that option.

You can make grants anonymously. Your name doesn’t have to appear on the cheque or in the annual report. And in a world where personal data is increasingly public, that can be a welcome safeguard.

7. Intergenerational Engagement and Legacy Building

DAFs don’t just offer tax benefits, they offer teaching moments. You can name successor advisors, bring in your children, and use the fund to express your family’s values over time. Giving becomes something you do together.

It might be a shared discussion around a holiday table. Or a more formal family meeting. Either way, it builds continuity, and, maybe, deeper purpose.

8. Access to Professional Grantmaking Support

Most DAF sponsors provide tools to help you give more effectively. That might mean research on a specific charity, insight into urgent funding gaps, or broader advice about philanthropic strategy. It’s support you might not get if you’re just giving directly.

You’re not navigating alone. You’ve got a team who understands both compliance and impact. That can make the difference between good giving and great giving.

9. Compliance Confidence with CRA Regulations

Let’s face it: charitable rules can be tricky. CRA guidelines, disbursement quotas, eligible donees, it’s a lot. With a DAF, most of that burden shifts to the sponsoring organization.

They ensure the grants are made to qualified recipients, and that all the back-end processes align with CRA expectations. You stay generous. They keep things legal and tidy.

10. Strategic Integration with Estate and Tax Planning

DAFs can live comfortably alongside your broader financial plans. They complement wills, trusts, RRSPs, and corporate structures, especially when coordinated through your advisor. For donors thinking long-term, that alignment is gold.

You might designate your DAF as a beneficiary. Or set it up to disburse in specific ways after your passing. Either way, it becomes part of the legacy you leave, not just a tax tool for today. This is one of the more strategic advantages of donor-advised funds.

FAQ

Can I change my mind about where to donate after I’ve contributed to a DAF?

Yes. Contributions are irrevocable, though you retain advisory privileges. You can recommend grants to different charities over time as your priorities evolve.

Do Donor-Advised Funds have minimum contribution requirements in Canada?

Yes, although they vary by sponsor. Some start as low as $5,000, whereas others may require $25,000 or more. It’s worth comparing before you commit.

Is it possible to donate non-cash assets like securities or private company shares?

In many cases, yes. Donating appreciated assets can provide added tax benefits and avoid capital gains. Always consult your financial advisor beforehand.

Donor-Advised Funds: A Smarter, More Personal Way to Give

Donor-Advised Funds aren’t just about streamlining donations or maximizing deductions. They’re about choice, intention, and setting up a structure that reflects how you want to give, both now and into the future. No matter if you’re donating a little or a lot, the advantages of donor-advised funds offer Canadians a practical, empowering way to make their generosity go further.